✍️ Original article by Abhinav Raghunathan, the creator of EAIDB who publishes content related to ethical ML / AI from both theoretical and practical perspectives.

This article is a part of our Ethical AI Startups series that focuses on the landscape of companies attempting to solve various aspects of building ethical, safe, and inclusive AI systems.

In our last issue, we talked about the “Targeted Solutions and Technologies” space. We now move to EAIDB’s last (but not least) category: AI governance, risk, and compliance (GRC). We consider these companies to be the “brakes” of the industry because they provide very deliberate checks on the limits of AI / ML. We particularly like this metaphor because to accelerate safely, brakes are essential.

The startups in this category typically come in one of two flavors. There are consulting firms and automated GRC platforms. Consulting firms can be legal or technology-based and place faith in human agents with practical, real-world experience handling and mitigating responsible AI risk. Some examples of consulting firms are Ethical Intelligence, TechInnocens, Kairoi, and INQ. These tend to have unique consultant backgrounds, geographic focuses, and subject expertise.

Automated platforms like Monitaur, Saidot, and Prodago attempt to provide control directly to an organization and place a high premium on cost, efficiency, and compliance.

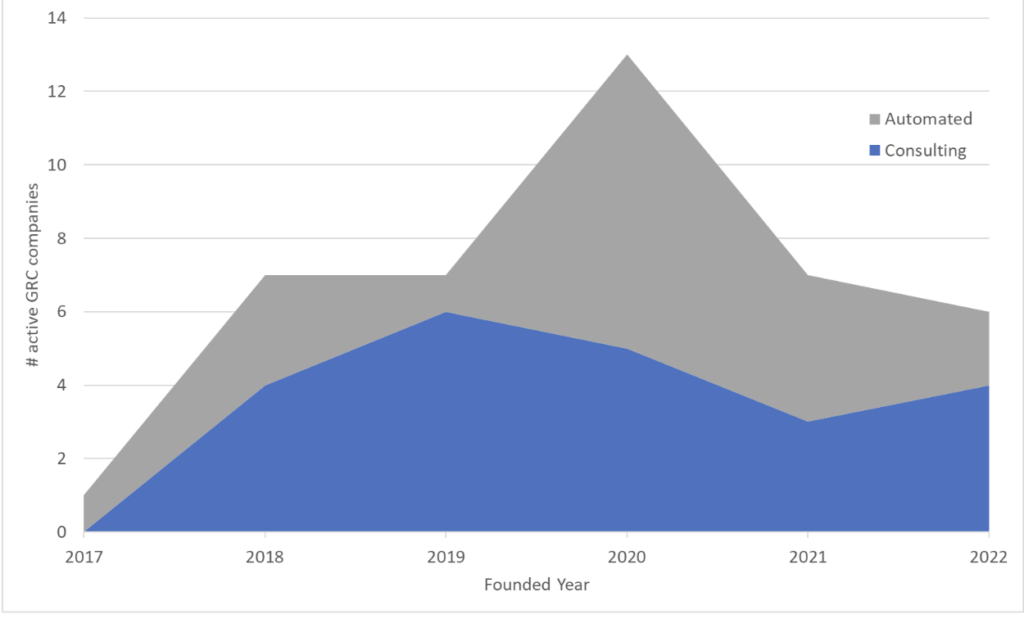

The distribution of companies within EAIDB’s AI GRC category is split almost 50–50 between the two types. Historically, this mixture of companies has been fairly volatile over the last ten years but has shifted towards more consulting firms over the last three years.

The unique aspect of these companies is that almost all of them focus exclusively on the business user as opposed to the data scientist or technical team. This contrasts quite starkly with other categories like “MLOps and Monitoring” and “Data for AI,” where companies tend to be divided into technical/non-technical approaches.

TRENDS

The number of consulting firms is rapidly growing.

Over the last five years, the number of “ethical consulting firms” has skyrocketed, primarily in response to changing conversations about responsible technology norms and regulations in Western countries. The number of firms listed in EAIDB has shown a CAGR of roughly 26% from 2019–2022. While this is encouraging from a topical perspective, there is some level of concern around market fragmentation; much of this growth may subside when corporate clients pick winners and losers.

Smaller firms do not typically see Big Four consulting firms as primary competitors.

The power of the largest, most successful consulting firms in the world comes from their “one size fits all” approach — they are very good with enterprise customers who have issues common to most enterprises but struggle to adapt their methods to extremely context-specific circumstances. Some larger firms have devoted a lot of time and energy to making this transition on the responsible technology front but still have a different client profile than the other firms in EAIDB (i.e., their clients typically have the budget to afford their services!).

BARRIERS

The demand problem is particularly challenging for consulting firms.

As a consulting firm, how do you fill demand in a challenging market? Firms generally have a set value proposition that is very difficult to change because it is based on the consultants’ skill sets. Some firms stress collaboration as the primary means of adapting to complex demand markets — sharing projects across multiple small firms increases the solution space by providing more perspective and financially benefits all those involved. This could be particularly difficult to achieve if the competitive environment between firms intensifies.

At some point, there may be market saturation.

At this stage in the market, many firms (consulting and automated) have remarkably similar products. The number of specific niches in the GRC market is small and therefore is bound to have some direct competitors. For example, within automated solutions, there are “policy box” platforms (which assess risk profiles given the set of compliance rules or “policy box” of a particular region or legal framework), testing and auditing platforms (which accept a model and a set of criteria and assess alignment with the criteria), and stakeholder inclusion platforms (which attempt to loop in stakeholders from all backgrounds). Most startups within the automated GRC space fall into one of these three categories. Therefore, approaches to solving problems in these buckets are not so unique relative to one another. Perhaps this implies that only a few remain in each category when the market chooses winners and losers.

However, another argument is that market saturation among consulting firms will never be reached. Ismael Kherroubi Garcia from Kairoi explains this theory best. “Completely responsible AI doesn’t exist — to narrow the gap between your current AI practices and some ideal standard, diversity of perspective is critical. An all-encompassing perspective is not attainable, much less so by working with just a few consultants at one firm. Closing the gap between current and ideal practices can only be obtained with constant collaboration across multiple firms with diverse expertise. Given the complexity of responsible AI, there is no such thing as too many consulting firms.”

OUTLOOK

Short-term and long-term product preferences may be quite different.

There often needs to be more clarity on what product type offers the best solution. It might seem that between consulting and automated solutions, there’s no space in the market for both to flourish, but the problems companies face are usually too complex for just one product. Already, many clients are relying on consulting firms to guide their use of automated solutions. Ethical consulting firms are also willing to establish technology partners with these automated solutions to broaden the effect of their guidance. INQ, a legal and technology firm focusing on data and AI risk, emphasizes that they are not committed to traditional methods – they routinely leverage automated solutions.

Other views identify an inflection point where the industry standard may shift from one approach to another. “Perhaps in the short-term,” Kherroubi Garcia theorizes, “automated solutions will be the go-to because of the need for immediacy to handle the rapidly changing regulatory landscape. In the long-term, consulting firms may take the lion’s share as companies have too many platform options and need guidance.”

Automated platform acquisitions or other exit types could be on their way.

Whether these startups have a 36-month technological lead on existing enterprise clients is still relatively unknown. If the answer is a resounding yes, acquisitions may arrive swiftly on the scene. Enterprises are notoriously difficult to govern because of their complex structures and numerous data teams (each deploying numerous models and applications), and platforms like those in the market today could soothe a major pain point if they prove to be scaleable.

Emerging markets show promise for GRC-related solutions over any other category in EAIDB.

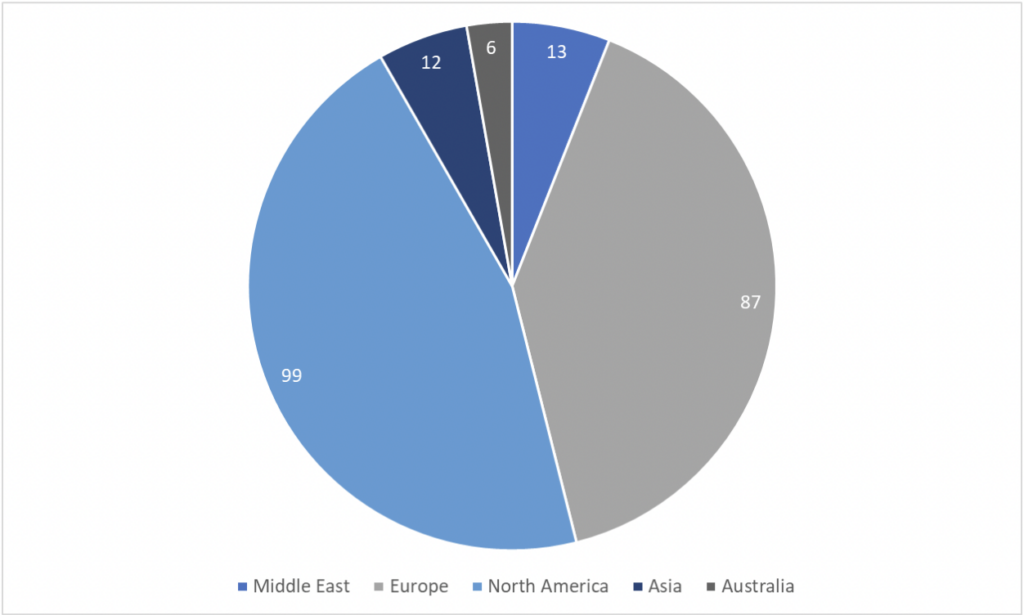

The current geographical distribution of companies in EAIDB is highly skewed toward Western countries. This is a highly-discussed topic, given that perspective and representation are key elements for a good, responsible technology strategy. AI GRC becomes even more critical because these companies also have a very strong voice in the ethical AI community.

There is a developing need in emerging markets (particularly Africa and Asia), and given that the rest of the world has watched Europe and North America make the same mistakes over and over again, there is a strong conviction in the community that the first products that emerging markets turn to are those in the AI GRC category. In essence, governance will precede innovation. Humanistic collaborations with consulting firms and quick but effective automated solutions in conjunction with the developing policy will provide a strong, opportunistic market. The need is ever-increasing as well. Matthew Newman of TechInnocens notes Australia’s current AI / ML environment includes “rapid uptake of third-party point solutions that directly address business managers’ requirements, which can often result in the late arrival of internal technology teams. This raises concerns in situations where the data science team’s project pipeline is the primary responsible-use focus because business managers haven’t been equipped to ask the right questions.” Combine this need with the idea that current products are far too expensive for most individuals or small businesses to purchase, creating an entirely new segment. Perhaps this will serve as an impetus for products like KomplyAI, a cost-effective risk assessment tool and community that lower the barriers to building responsible AI.

This is the last issue of the EAIDB category series. While there is one more category (focused on open-source technologies), the entities within are of the non-profit or institutional variety. To learn more about this space, read EAIDB’s State of the Ecosystem 2022 report. EAIDB is the first publicly-available database of AI startups either providing ethical services or addressing areas of society historically riddled with bias. Learn more about the mission of EAIDB at https://eaidb.org.